Get the free ez 1building materialsexemption certificaion illinois department of revenue form - r...

Show details

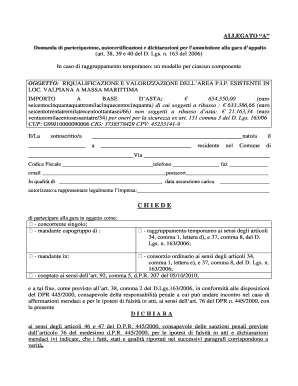

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of Revenue EZ-1Building Materials Exemption Certification Step 1: Identify

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ez 1building materialsexemption certificaion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ez 1building materialsexemption certificaion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ez 1building materialsexemption certificaion online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ez 1building materialsexemption certificaion. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out ez 1building materialsexemption certificaion

How to fill out ez 1building materialsexemption certificaion:

01

Obtain the ez 1building materialsexemption certificaion form from the appropriate authority or organization.

02

Fill in your personal and contact information accurately, including your name, address, phone number, and email.

03

Provide the details of the building project for which you are seeking the exemption, such as the address, purpose, and scope of work.

04

Indicate the specific types of building materials that you are seeking exemption for, and provide a brief explanation of why they should be exempted (e.g., environmentally friendly, locally sourced, etc.).

05

Include any supporting documentation or certificates that may be required to support your exemption request.

06

Sign and date the form to confirm the accuracy and authenticity of the information provided.

07

Submit the completed ez 1building materialsexemption certificaion form to the appropriate authority or organization according to their instructions.

Who needs ez 1building materialsexemption certificaion:

01

Contractors or builders who are engaged in construction projects that involve the use of building materials.

02

Individuals or organizations seeking to obtain an exemption for specific building materials based on environmental, sustainability, or other criteria.

03

Authorities or organizations responsible for issuing or granting exemptions for building materials used in construction projects.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file ez 1building materialsexemption certificaion?

EZ 1 Building Materials Exemption Certification forms are usually required to be filed by contractors or builders who are purchasing building materials for a project that qualifies for a sales tax exemption. This form is used to certify that the materials will be used exclusively for the construction or improvement of a qualifying project, such as a government or non-profit organization project. The specific requirements may vary depending on the jurisdiction, so it's advisable to consult local tax authorities or a tax professional for more accurate information.

How to fill out ez 1building materialsexemption certificaion?

To fill out an EZ-1 Building Materials Exemption Certification, follow these steps:

1. Obtain a copy of the EZ-1 Building Materials Exemption Certification form. This form is typically provided by the state or local tax authority or can be downloaded from their website.

2. Begin by entering the relevant information in the header section of the form. This usually includes the current date, the name of the company or individual filing the form, the address, and any tax identification numbers.

3. In the section labeled "Project Description," provide a brief description of the construction project for which the building materials will be used. Include information such as the project name, location, and purpose.

4. The next section typically requires you to specify the building materials that are exempt from sales tax. This may vary depending on your jurisdiction, but common examples include concrete, lumber, nails, cement, paint, etc. Provide a detailed list of the materials that will be purchased without tax.

5. Indicate the intended use of the building materials. Specify whether they will be used solely for the construction of a new building, improvement to an existing building, or any other relevant purpose. Some jurisdictions may have specific categories for the intended use, so make sure to select the one that best describes your situation.

6. In the "Certification" section, you'll need to sign and date the form, certifying that the information provided is accurate. Some jurisdictions may require additional details, such as the authorized representative's name and position within the company.

7. Review the completed form for accuracy and completeness. Ensure that all required sections are filled out correctly and that any necessary supporting documentation, if mentioned, is attached.

8. Once reviewed, make a copy of the filled-out form for your records.

9. Submit the completed EZ-1 Building Materials Exemption Certification form to the appropriate tax authority. Follow the submission instructions outlined by your jurisdiction, which may involve mailing the form, submitting it electronically, or delivering it in person.

Remember to consult with your local tax authority or seek professional advice to ensure compliance with specific jurisdictional requirements and to thoroughly understand the process of claiming the exemption.

What is the purpose of ez 1building materialsexemption certificaion?

The purpose of the ez1 Building Materials Exemption Certification is to provide a tax exemption on eligible construction materials used in qualified research and development facilities, as defined by the Texas Comptroller of Public Accounts. This certification enables businesses to claim an exemption from state sales and use taxes on building materials used in the construction, renovation, or expansion of such qualified facilities. By receiving the ez1 exemption, businesses can reduce the overall cost of construction projects and encourage investment in research and development within the state of Texas.

What information must be reported on ez 1building materialsexemption certificaion?

The information that must be reported on the EZ 1 Building Materials Exemption Certification includes the following:

1. Name and address of the seller: The name and address of the company or individual selling the building materials exempt from tax.

2. Name and address of the purchaser: The name and address of the buyer who is claiming the exemption.

3. Date of purchase: The date on which the purchase of the building materials was made.

4. Description of the building materials: A detailed description of the materials being purchased, including quantity, type, and any other relevant specifications.

5. Intended use of the materials: The specific purpose for which the building materials will be used, such as construction, renovation, repair, etc.

6. Certificate of exemption number: If applicable, the certificate of exemption number, which indicates that the buyer is eligible for tax exemption.

7. Signature and date: The document should be signed and dated by both the seller and the purchaser to acknowledge the accuracy of the information provided.

It is important to note that the specific requirements for reporting may vary depending on the jurisdiction or tax authority. It is advisable to consult the local tax regulations or seek professional advice to ensure compliance with the relevant reporting requirements in your specific area.

What is the penalty for the late filing of ez 1building materialsexemption certificaion?

The penalty for the late filing of EZ-1 Building Materials Exemption Certification may vary depending on the specific jurisdiction and regulations in place. Generally, late filing penalties may include fines or additional fees imposed by the governing tax authority. The exact penalty amount and consequences for late filing can be obtained by referring to the specific laws and regulations governing the EZ-1 Building Materials Exemption Certification in your jurisdiction or by consulting with a tax professional.

How can I manage my ez 1building materialsexemption certificaion directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign ez 1building materialsexemption certificaion and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute ez 1building materialsexemption certificaion online?

Completing and signing ez 1building materialsexemption certificaion online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in ez 1building materialsexemption certificaion?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your ez 1building materialsexemption certificaion to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Fill out your ez 1building materialsexemption certificaion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.